In the ever-evolving landscape of financial technology, the need for secure and privacy-preserving data sharing is paramount. Financial institutions, particularly banks, are continually seeking advanced solutions to enhance their data analytics capabilities while maintaining stringent data privacy standards. Inpher’s XOR software, combined with trusted execution environment (TEE) hardware, presents a groundbreaking approach to achieving this balance. This blog post delves into how XOR and TEE hardware work together to protect data during processing, with a specific focus on a compelling use case involving two banks and the SWIFT messaging network.

The Challenge

The challenge faced by financial institutions is twofold. First, there is a pressing need to improve the predictive power of AI models. This improvement is heavily dependent on the aggregation of data from multiple banks. However, under current circumstances, banks and messaging platforms can only access their own data. This limitation hampers the development of more robust and accurate models, particularly in areas such as fraud detection.

Second, the privacy and security of data are non-negotiable. Banks need to ensure that sensitive information is not exposed or compromised during data sharing and processing. The solution to these challenges lies in the creation of a dedicated, infrastructure-agnostic platform for federated AI that can seamlessly integrate diverse data sources while preserving privacy.

The Solution

Microsoft Confidential Computing and Inpher’s XOR Platform provide a powerful combined solution to address these challenges. Let’s explore how each component contributes to this innovative approach:

Microsoft Confidential Computing

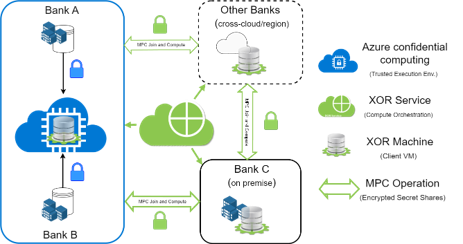

Microsoft Confidential Computing offers a secure environment where data can be processed without exposing it to unauthorized access. It allows banks to share and process data within a trusted environment, ensuring that sensitive information remains confidential. By incorporating features from banks that have agreed to share their data in this trusted environment, financial institutions can significantly enhance their data analytics capabilities.

Inpher’s XOR Platform

Inpher’s XOR Platform extends the capabilities of Microsoft Confidential Computing by enabling privacy-preserving data processing even when data is stored in disparate locations. XOR allows the integration of data from banks that keep their data on their own premises or in their cloud environments. This means that banks can maximize data access and collaboration without compromising on data privacy.

A Practical Use Case

To illustrate the potential of this solution, consider a scenario involving two banks that need to collaborate on data analytics without directly sharing their private data. These banks have their data stored on Azure, with one bank adhering to strict on-premise data policies. The goal is to run analytics on features used to target transactions similar to those communicated through the SWIFT network, which facilitates most international money and security transfers.

Federated AI for Enhanced Fraud Detection

In this scenario, the banking network aims to build a federated AI platform that integrates diverse data sets to enhance fraud detection. By leveraging Microsoft Confidential Computing, the network can securely incorporate features from banks willing to share their data within the trusted environment. Simultaneously, Inpher’s XOR Platform allows the inclusion of features from banks that prefer to keep their data in their own secure environments.

This federated approach ensures that all participating banks can contribute to and benefit from improved AI models without exposing their sensitive data. The platform remains infrastructure-agnostic, enabling seamless integration of data from various sources and enhancing the overall predictive power of the models.

Conclusion

The combination of Inpher’s XOR software and trusted execution environment hardware marks a significant advancement in the privacy-preserving data sharing landscape. For financial institutions, this approach offers a secure and efficient way to enhance data analytics capabilities while maintaining stringent data privacy standards. By enabling federated AI and integrating diverse data sources, banks can better identify and prevent fraudulent activities, ultimately fostering a more secure and robust financial ecosystem.

As the financial industry continues to evolve, solutions like XOR and TEE hardware will play a crucial role in driving innovation and maintaining trust in data privacy. Financial institutions that embrace these technologies will be well-positioned to navigate the complexities of data sharing and analytics in the digital age.